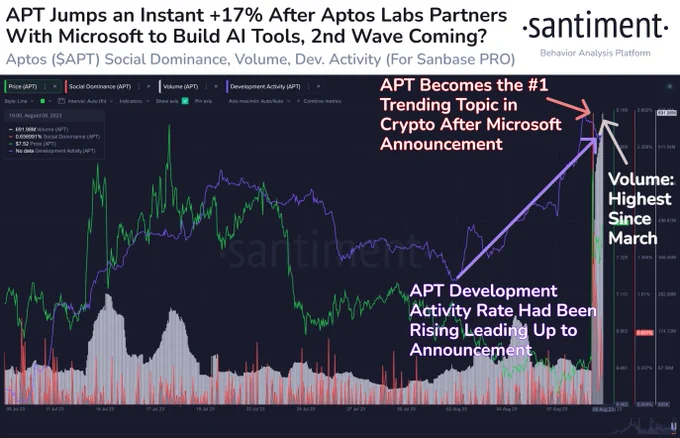

Back when Aptos announced its collaboration with Microsoft, in which they decided to codevelop AI tools tailored to blockchain integrations, we saw a surge of enthusiasm and an undeniable fear of missing out (FOMO) among crypto enthusiasts. While the initial hype has simmered down, this is not a sign of dwindling interest. Instead, it hints at the maturity and patience of the investors who are watching the crypto's next moves closely.

To add fuel to the excitement, let's consider a hypothetical: what if Aptos took a leaf out of Solana's playbook? Drawing parallels, if Aptos were to emulate Solana's illustrious price trajectory, we might witness Aptos (APT) reaching the coveted $37 mark.

#Aptos has decoupled after its partnership with #Microsoft was announced to build A.I. tools for #blockchain integrations. The crowd showed major #FOMO, but has calmed down. However, rising volume & dev. activity may foreshadow another higher high.

https://t.co/vFgMZQo7Io pic.twitter.com/Ub2MGu0QFC

— Santiment (@santimentfeed) August 10, 2023

The argument strengthens when you consider that Solana consistently remained above the $1 benchmark. Hence, should Aptos falter and drop below $5, it would diverge from this projected path, serving as an invalidation of this speculative comparison.

Now, turning our attention to the present, Aptos is far from being stagnant. Just yesterday, it tacked on an impressive 9% gain, positioning its current trading value at a promising $7.31. This is not merely an erratic spike. Rising trading volumes, coupled with an uptick in developer activity, are reliable indicators of budding momentum. These might be initial signs of the cryptocurrency gearing up to hit another "higher high" soon.

While predictions on the volatile cryptocurrency market are always filled with uncertainty, the trajectories and patterns do provide some food for thought. Aptos's recent activities and performance certainly paint a hopeful picture. Whether it reaches the speculated $37 or charts its own unique course, only time will tell. For now, investors and crypto-enthusiasts might want to keep a close watch on this intriguing crypto contender.

Cryptocurrency exchanges review:

#1

OKX - 24h Volume: $ 1 097 255 972.

OKX is an Hong Kong-based company founded in 2017 by Star Xu. Not available to users in the United States.

#2

ByBit - 24h Volume: $953 436 658.

It is headquartered in Singapore and has offices in Hong Kong and Taiwan. Bybit works in over 200 countries across the globe with the exception of the US.

#3

Gate.io - 24h Volume: $ 643 886 488.

The company was founded in 2013. Headquartered in South Korea. Gate.io is not available in the United States.

#4

MEXC - 24h Volume: $ 543 633 048.

MEXC was founded in 2018 and gained popularity in its hometown of Singapore. US residents have access to the MEXC exchange.

#5

KuCoin - 24h Volume: $ 513 654 331.

KuCoin operated by the Hong Kong company. Kucoin is not licensed to operate in the US.

#6

Huobi - 24h Volume: $ 358 727 945.

Huobi Global was founded in 2013 in Beijing. Headquartered in Singapore. Citizens cannot use Huobi in the US.

#7

Bitfinix - 24h Volume: $ 77 428 432.

Bitfinex is located in Taipei, T'ai-pei, Taiwan. Bitfinex is not currently available to U.S. citizens or residents.

My bitcoin-blog:

https://sites.google.com/view/my-crypto-jam/ripple

=)